In 2022, if you’re single and have $15,000 of taxable income, you’re in the 12% tax bracket, while if you’re single and have taxable income of $600,000, you’re in the 37% tax bracket.īut this doesn't mean that all your income is taxed at that rate, as there's a difference between a marginal tax rate and an effective tax rate.

There are graduated tax brackets, with rates ranging from 10% to 37%.įor the 2022 tax year (tax returns filed in 2023), those tax brackets are: Tax Rate In the U.S., the federal income tax is progressive.

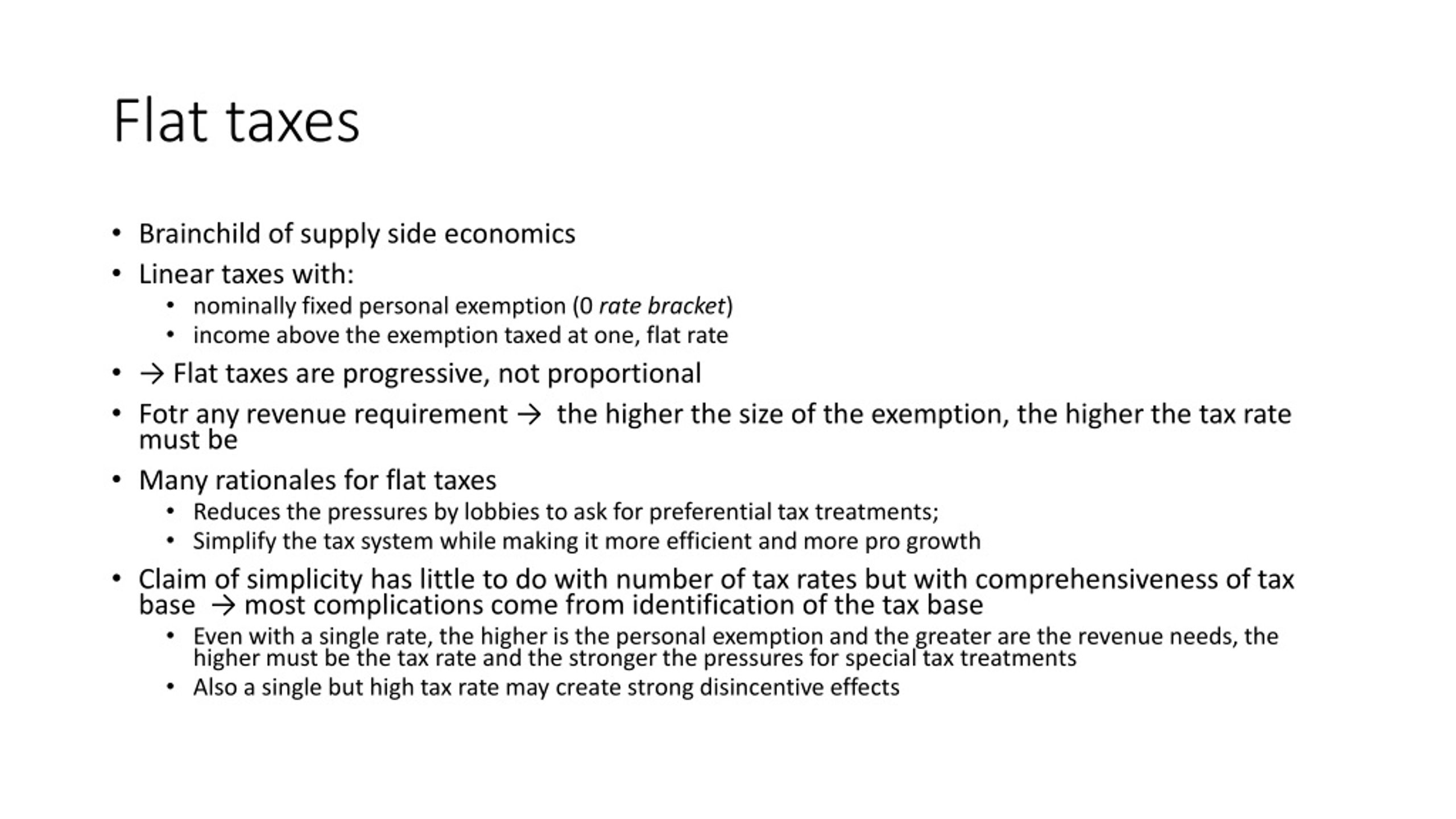

But what is a progressive tax? And how does it compare to a regressive or flat tax? What is a progressive tax?Ī progressive tax is when the tax rate you pay increases as your income rises. The taxes you pay on your income and purchases can take several forms, including progressive tax, regressive tax, and flat taxes.

0 kommentar(er)

0 kommentar(er)